Set Up or Change Your Direct Deposit of Benefit Payment

Do you want to set up or change the direct deposit of your benefit payment? We are constantly expanding and improving our online services, including the ability to set up or change your direct deposit information. If you already receive Social Security or Supplemental Security Income (SSI) benefits and you have a bank account, simply log in to or create your personal and secure mySocial Security account.

What is Direct Deposit?

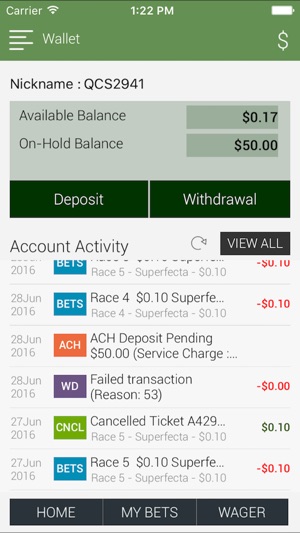

- 4 13:40 - interbet.co.za 0861 150 160 Fm 92 Handicap (F & M). Sign up to MansionBet deposit and bet £10 and get £20 in free bets. New customers only, min deposit.

- Log In: Enter your user name and password. User Name:. Password:. Rememer me next time.

- Interbet Withdrawals & Deposits. Find a host of deposit and withdrawal methods that you are accustomed to using online in South Africa. Here's a list of platforms you can use to transfer funds into your Interbet account: Credit Cards from the major banks such as ABSA, FNB, Nedbank, Standard Bank, and Investec; Cheque.

A 100% new customer Bonus up to £200 will enlarge your funds at Interbet. If you deposit £200, you will get the maximum Bonus amount of £200, so you will have £400 added to your balance. Games from various software providers like NetEnt, Play'n GO as well as Big Time Gaming, to state a few, are compatible with your Bonus Funds. Min deposit £10. A qualifying bet is a ‘real money' stake of at least £10. Min odds 1/2 (1.5). Free Bets credited upon qualifying bet settlement and expires after 7 days. Free Bet stakes not included in returns. Deposit balance is available for withdrawal at any time. Casino Bonus must be claimed within 7 days. To withdraw bonus/related wins, wager bonus amount x40.

Direct deposit is a simple, safe, and secure way to get benefits. If you need us to send your payment to a bank or credit union account, have all of the following information ready when you apply.

- Social Security number

- Bank routing transit number

- Account type (checking or savings)

- Account number

How to Set Up or Change Direct Deposit of Benefit Payment Online

- Log in to your account.

- Sign in and Select the blue Benefits & Payment Details link on the right side of the screen.

- Scroll down and select the Update Direct Deposit button, and choose if you are the owner or co-owner of the bank account.

- Enter your bank account information and select Next.

- Review and verify your banking information and select Submit then select Done.

- You can also decide when your change will take effect, by simply using the My Profile tab within mySocial Security.

Don't have a mySocial Security Account?

Creating a free mySocial Security account takes less than 10 minutes, lets you set up or change your direct deposit and gives you access to many other online services.

Additional information related to this service

As of March 1, 2013, you are required to receive your payments electronically. If you applied for benefits before that date and did not sign up for electronic payments at that time, we strongly urge you to do so now. For more information regarding switching to an electronic payment if you don't have a bank account, visit Treasury's Go Direct website or call the helpline at 1-800-333-1795.

Still have questions?

If you have questions or need help understanding how to set up or change direct deposit online, call our toll-free number at 1-800-772-1213 or visit your Social Security office. If you are deaf or hard of hearing, call our toll-free TTY number, 1-800-325-0778, between 8:00 a.m. and 5:30 p.m. Monday through Friday.

How mobile deposit works

Explore these simple steps to deposit checks in minutes.

Fcmb Internet Banking Corporate

1. Download the Wells Fargo Mobile app to your smartphone or tablet.

2. Sign on to your account.

3. Select Deposit in the bottom bar. Or, use the Deposit Checks shortcut.

1. Select an account from the Deposit to dropdown. If you have set up a default account, it will already be pre-selected.

2. If you want to create or change your default account, go to the Deposit to dropdown and select the account you want to make your default, then select Make this account my default.

1. Enter the check amount. Your account's remaining daily and 30-day mobile deposit limit will also display on the screen.

2. Make sure the amount entered matches the amount on your check, and select Continue.

1. Sign the back of your check and write 'For Mobile Deposit at Wells Fargo Bank Only' below your signature (or if available, check the box that reads: 'Check here if mobile deposit').

2. Take a photo of the front and back of your endorsed check. You can use the camera button to take the photo. For best results, use these photo tips:

• Place check on a dark-colored, plain surface that's well lit.

• Position camera directly over the check (not angled).

Set Up or Change Your Direct Deposit of Benefit Payment

Do you want to set up or change the direct deposit of your benefit payment? We are constantly expanding and improving our online services, including the ability to set up or change your direct deposit information. If you already receive Social Security or Supplemental Security Income (SSI) benefits and you have a bank account, simply log in to or create your personal and secure mySocial Security account.

What is Direct Deposit?

- 4 13:40 - interbet.co.za 0861 150 160 Fm 92 Handicap (F & M). Sign up to MansionBet deposit and bet £10 and get £20 in free bets. New customers only, min deposit.

- Log In: Enter your user name and password. User Name:. Password:. Rememer me next time.

- Interbet Withdrawals & Deposits. Find a host of deposit and withdrawal methods that you are accustomed to using online in South Africa. Here's a list of platforms you can use to transfer funds into your Interbet account: Credit Cards from the major banks such as ABSA, FNB, Nedbank, Standard Bank, and Investec; Cheque.

A 100% new customer Bonus up to £200 will enlarge your funds at Interbet. If you deposit £200, you will get the maximum Bonus amount of £200, so you will have £400 added to your balance. Games from various software providers like NetEnt, Play'n GO as well as Big Time Gaming, to state a few, are compatible with your Bonus Funds. Min deposit £10. A qualifying bet is a ‘real money' stake of at least £10. Min odds 1/2 (1.5). Free Bets credited upon qualifying bet settlement and expires after 7 days. Free Bet stakes not included in returns. Deposit balance is available for withdrawal at any time. Casino Bonus must be claimed within 7 days. To withdraw bonus/related wins, wager bonus amount x40.

Direct deposit is a simple, safe, and secure way to get benefits. If you need us to send your payment to a bank or credit union account, have all of the following information ready when you apply.

- Social Security number

- Bank routing transit number

- Account type (checking or savings)

- Account number

How to Set Up or Change Direct Deposit of Benefit Payment Online

- Log in to your account.

- Sign in and Select the blue Benefits & Payment Details link on the right side of the screen.

- Scroll down and select the Update Direct Deposit button, and choose if you are the owner or co-owner of the bank account.

- Enter your bank account information and select Next.

- Review and verify your banking information and select Submit then select Done.

- You can also decide when your change will take effect, by simply using the My Profile tab within mySocial Security.

Don't have a mySocial Security Account?

Creating a free mySocial Security account takes less than 10 minutes, lets you set up or change your direct deposit and gives you access to many other online services.

Additional information related to this service

As of March 1, 2013, you are required to receive your payments electronically. If you applied for benefits before that date and did not sign up for electronic payments at that time, we strongly urge you to do so now. For more information regarding switching to an electronic payment if you don't have a bank account, visit Treasury's Go Direct website or call the helpline at 1-800-333-1795.

Still have questions?

If you have questions or need help understanding how to set up or change direct deposit online, call our toll-free number at 1-800-772-1213 or visit your Social Security office. If you are deaf or hard of hearing, call our toll-free TTY number, 1-800-325-0778, between 8:00 a.m. and 5:30 p.m. Monday through Friday.

How mobile deposit works

Explore these simple steps to deposit checks in minutes.

Fcmb Internet Banking Corporate

1. Download the Wells Fargo Mobile app to your smartphone or tablet.

2. Sign on to your account.

3. Select Deposit in the bottom bar. Or, use the Deposit Checks shortcut.

1. Select an account from the Deposit to dropdown. If you have set up a default account, it will already be pre-selected.

2. If you want to create or change your default account, go to the Deposit to dropdown and select the account you want to make your default, then select Make this account my default.

1. Enter the check amount. Your account's remaining daily and 30-day mobile deposit limit will also display on the screen.

2. Make sure the amount entered matches the amount on your check, and select Continue.

1. Sign the back of your check and write 'For Mobile Deposit at Wells Fargo Bank Only' below your signature (or if available, check the box that reads: 'Check here if mobile deposit').

2. Take a photo of the front and back of your endorsed check. You can use the camera button to take the photo. For best results, use these photo tips:

• Place check on a dark-colored, plain surface that's well lit.

• Position camera directly over the check (not angled).

• Fit all 4 corners inside the guides on your mobile device's screen.

1. Make sure your deposit information is correct, then select Deposit.

Internet Deposit Accounts

2. You'll get an on-screen confirmation and an email letting you know we've received your deposit.

Internet Deposits Definition

3. After your deposit, write 'mobile deposit' and the date on the front of the check. You should keep the check secure for 5 days before tearing it up.

Internet Deposit

Still have questions?

Quick Help

Call Us

Find a Location

Mobile deposit is only available through the Wells Fargo Mobile® app. Deposit limits and other restrictions apply. Some accounts are not eligible for mobile deposit. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. See Wells Fargo's Online Access Agreement for other terms, conditions, and limitations.

LRC-0620